Willis Towers Watson 韦莱韬悦

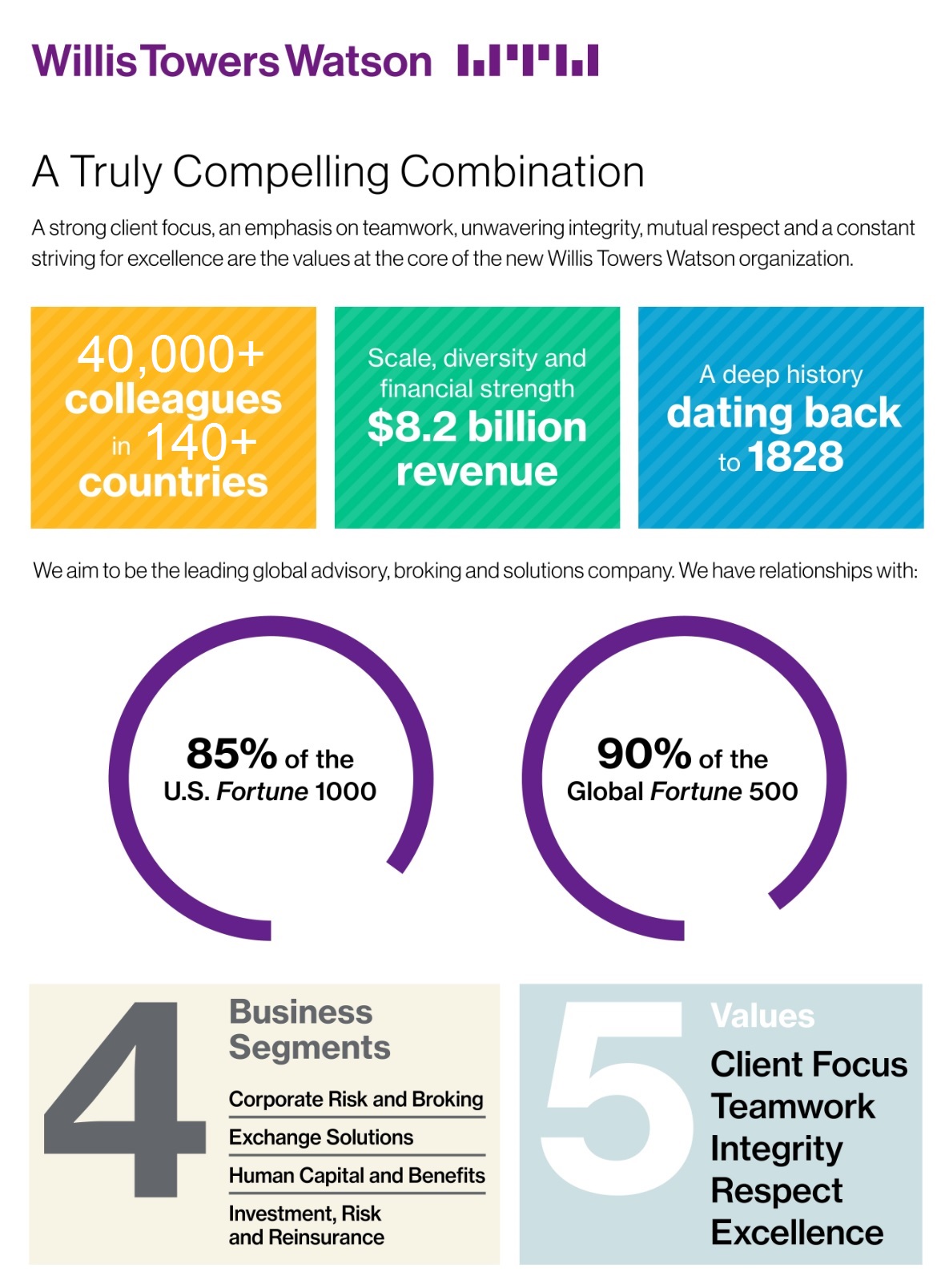

Willis Towers Watson (NASDAQ: WLTW) is a leading global advisory, broking and solutions company that helps clients around the world turn risk into a path for growth. With roots dating to 1828, Willis Towers Watson has 40,000+ employees in more than 140 countries. We design and deliver solutions that manage risk, optimize benefits, cultivate talent, and expand the power of capital to protect and strengthen institutions and individuals. Our unique perspective allows us to see the critical intersections between talent, assets and ideas – the dynamic formula that drives business performance.

Together, we unlock potential.

Learn more at willistowerswatson.com.

Willis Towers Watson (NASDAQ: WLTW) 是一家领先的全球性咨询、保险经纪和解决方案公司,帮助世界各地的客户把风险变成增长机遇。自 1828 年成立以来,Willis Towers Watson 已在 140 多个国家拥有 40,000 名员工。我们设计和提供完善的解决方案来管理风险、实现利益最大化、培育人才及增强资本力量,让组织与个人得到有力保障。我们以独到眼光洞察人才、资产与理念之间的重要交集—这是推动经营绩效增长的动态公式。

与您携手,激发潜能。

韦莱韬悦 官方网站 : willistowerswatson.com.

Services

Services

- Corporate Risk and Broking

- Exchange Solutions

- Human Capital and Benefits

- Investment, Risk and Reinsurance

Our History

Our History – A History of Shared Values

A strong client focus, an emphasis on teamwork, unwavering integrity, mutual respect and a constant striving for excellence are the values at the core of Willis Towers Watson’s rich history. Many of our clients have been with us from our earliest days. Whether they first came to us for brokerage services or actuarial work, they were met with respect, a strong sense of advocacy and an emphasis on excellence. These values will continue to define our approach to business and our relationship with our clients, now and in the future.

The birth of insurance broking and the actuarial profession

1828 — Henry Willis began his career as a merchant selling imported goods on commission in the U.K. at the Baltic Exchange in London.

1841 — Willis applied for membership of Lloyd’s, where he started to broker insurance for the cargoes of commodities he sold on commission. As his enterprise grew, he became involved in the hull business, establishing himself in marine insurance and founding Henry Willis & Company.

1865 — Predecessor actuarial consulting firm Fackler & Co. was founded in New York.

1878 — Reuben Watson formed R. Watson & Sons, the world’s oldest actuarial firm, when the Manchester Unity of Oddfellows appointed him actuary the same year. Manchester Unity remains a client today — as do many of our earliest actuarial and brokerage clients.

1889 — Peter Fackler helped create the Actuarial Society of America, a predecessor of today’s Society of Actuaries. The company’s consulting actuaries have a long history of involvement in professional societies, serving on committees and boards, and helping shape the actuarial profession. Today, we remain one of the world’s largest employers of actuaries.

Establishing ourselves at the forefront of our industries

1896 — Henry Willis & Co. developed a relationship with U.S.-based Johnson & Higgins, which provided Willis access to the U.S. market.

1898 — Henry Willis & Co merged with Faber Brothers to form Willis, Faber & Co and developed a huge marine account, reputedly the largest broking portfolio in the world.

1928 — Willis Faber & Company merged with Dumas & Wylie Limited to form Willis, Faber & Dumas.

1910s — After the passage of the National Insurance act of 1911, R. Watson & Sons became the lead advisor to the U.K. government on national insurance programs.

1920s — Walter Forster, a founder of a predecessor company and known as the “father of pension planning,” sold one of the first major insured pension plans to Eastman Kodak Company.

1934 — Towers, Perrin, Forster & Crosby (TPF&C) was founded. It initially operated a reinsurance and life division, eventually specializing in pensions, reinsurance brokerage and employee benefit plans.

Adapting to an increasingly connected world

1943 — Birchard Wyatt formed the Wyatt Company, an actuarial consulting firm, in Washington, D.C.

1950 — Fackler & Co. was acquired by the Wyatt Company.

1950s and beyond — Private pensions continued to grow in popularity, leading to a boom in actuarial business on both sides of the Atlantic, and solidifying our position among the largest actuarial consulting forces in Europe and North America.

1960s — TPF&C expanded its services to include health care, compensation and organizational consulting

1976 — Willis, Faber & Dumas listed on the London Stock Exchange, signifying its status as the leading U.K. specialty broker.

Expanding globally and adding capabilities

1970s and 1980s — Regulatory change and rising employee benefit costs in the U.S. spurred a further need for actuarial expertise.

1980s — Willis’ reinsurance business expanded and eclipsed marine broking for the first time.

1986 — Towers, Perrin, Forster & Crosby acquired Atlanta-based Tillinghast, Nelson & Warren.

1987 — Towers, Perrin, Forster & Crosby was renamed Towers Perrin.

1990 — Willis, Faber & Dumas entered the U.S. as a retail broker through a merger with Corroon & Black, establishing it as the world’s fourth-largest insurance broker.

1995 — R. Watson & Sons and The Wyatt Company forged an alliance, forming Watson Wyatt and consolidating their global resources.

1995 — Willis acquired a 33% stake in French broker Gras Savoye.

1997 — Willis Corroon was privatized by Kohlberg Kravis Roberts in a $1.4 billion deal.

1998 — Willis operations were amalgamated under one name: Willis Group.

2000 — Watson Wyatt was listed on the New York Stock Exchange.

Helping our clients succeed in a more uncertain world

2001 — Willis Group was listed on the New York Stock Exchange and experienced strong growth.

2006 — Willis Research Network was launched as the world’s largest collaboration between academic institutions and the finance sector.

2008 — Willis Group’s U.S. presence was doubled with a $2.1 billion Hilb Rogal & Hobbs acquisition.

2010 — In a merger of equals, Towers Perrin and Watson Wyatt combined to form Towers Watson.

2012 — Towers Watson acquired Extend Health and entered the private health care exchange market in the U.S.

2015 — Willis Group exercised its right to acquire the remainder of Gras Savoye and agreed to purchase 85% of Miller, the leading London independent wholesale insurance broker.

2016 — Willis Group and Towers Watson merge to become Willis Towers Watson.